Hi, it’s Danya from Grats Group. Which virtual cards are better? The eternal question that all media buyers ask themselves. In this article our team has tried to give a comprehensive answer to it. Few words about our team: we have extensive and successful experience with gambling vertical in Google Ads and now we are actively running traffic in Facebook Ads. That’s why we decided to refresh our knowledge of the best payment solutions for media buying.

We collected data on the most popular virtual payment card services (we are using one of them already), found all hidden fees and actually checked whether they work so well with advertising platforms.

In the course of our research, we have studied the key stages of working with payment services:

- Account creation

- Card issuance

- Linking cards to advertising accounts

- Running the traffic

- Calculating actual fees for virtual cards

Our article contains several comparison tables for maximum clarity plus there are final thoughts in the end. So let's begin!

1. Sign-up and log-in

As every journey starts from the first step, working with a payment service starts from registration. Let’s compare what data is needed for access to the chosen payment services:

Brocard (mybrocard.com) sign up and reviews

Sign-up process at Mybrocard is complicated by the necessity for an interview to get access to the service. After filling out the questionnaire, potential clients will have to wait. It is promised to consider the application within 24 hours (on weekdays). There is an invite system as well. b style="color:#000;">You’ll need to show your documents to the camera for verification.

De facto it took us about three working days to set up the call and pass KYC at Brocard. Perhaps there was some kind of technical issue, but we had to remind Brocard support about our verification request, they just forgot about us. During the interview, we were asked about the size of our team, traffic sources, plans for spends and cards, preferences for top-up methods and partner networks. In addition we were asked to provide screenshots of statistics from our ad accounts as well. A little bit more waiting and now we have access to virtual cards from Brocard.

There are no Trustpilot reviews. There are reviews from some John, Alex, Mike и Rob on the website, they assure us that Brocard is the best service worth the long registration process.

Log in is available through either login and password or with Facebook and Google accounts.

PST.NET (pst.net) sign up and reviews

Sign up process on PST (short for pay, store, transfer) turned out to be much easier. There was no need for KYC for the first card and spendings less than $500. We were counting on a bigger spend, so we verified our account. Verification at PST (which is just sending the document photo) took us an hour, plus we were given the opportunity to test the plan for teams ($1 per card and 2% top-up commission).

The overall service rating on Trustpilot is 4.3 (Excellent).

Customers can sign-in to the service with login-password or using Telegram and Google accounts.

Capitalist (capitalist.net) sign up and reviews

The Capitalist payment system greets us with extensive data fields for registration (6 entries for individuals or 7 entries for business representatives). It takes several hours to verify the documents (we spent around 2-3 hours).

The service rating on Trustpilot is 4.2 (Great).

Login to the service is available only by traditional login-password pair, no innovations here.

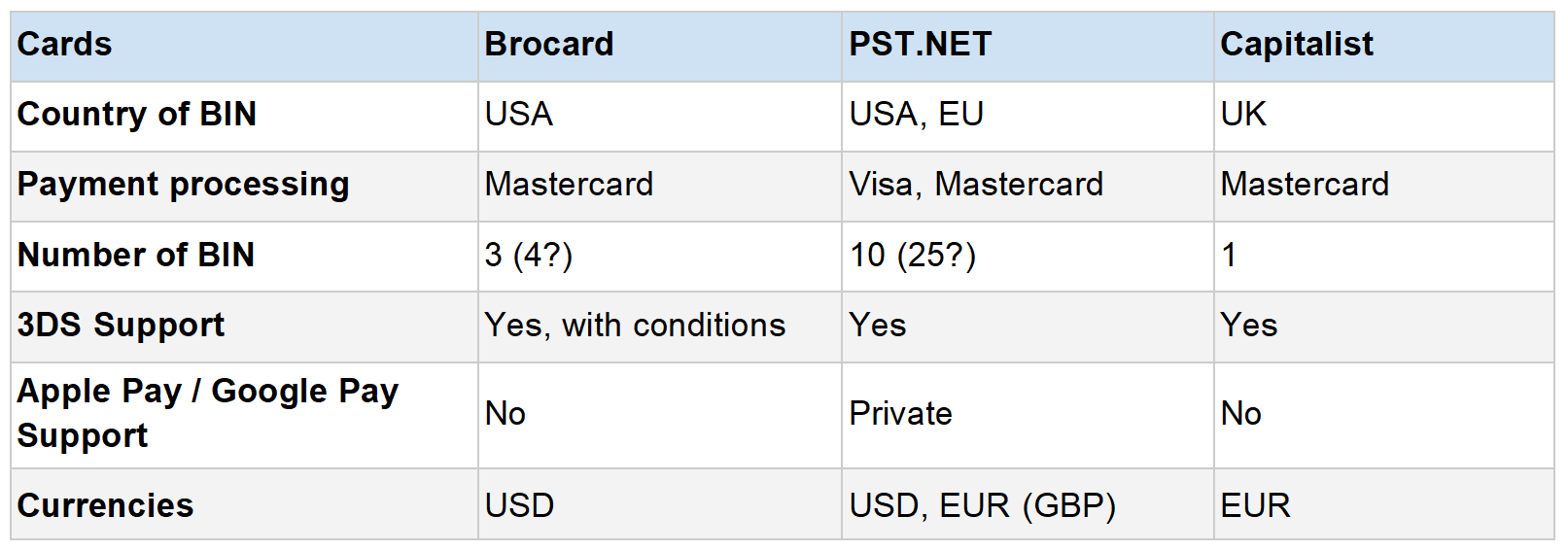

2. Cards and BIN

What is the most important part of a virtual card service? Sure, the quality of the cards. We are keen on what BIN, payment processing and card types these services offer.

Cards from Brocard

There are 3 BIN (USA) and 3 card types (USD only) available:

- 531367 Mastercard Credit Prepaid USD – for all permitted payments

- 539406 Mastercard Credit USD – same as above

- 555608 Mastercard Credit USD – cards with their own balance which are only suitable for paying for advertising services such as Google and Facebook Ads.

There are cards with 3D Secure, but they are available only after 100 payments are made, “if the percentage of rejected transactions is less than 10-15%”, according to support.

There is no Apple Pay and Google Pay support for offline payments.

Cards from PST

There are 25 BIN and 6 card types available for users, at least that’s what is mentioned on the website. Cards are in USD and EUR, yet GBP cards are promised to be available soon as well. However, only 10 BIN (USA) and 4 card types were available in our account, for the rest apparently you’ll need to contact the customer care service.

A little bit more about the cards from PST:

- Premium Facebook Card (Mastercard/Visa) – card for Facebook Ads only, with trusted BIN and low fees, yet transaction fee are applied

- Advertisement Card (Mastercard/Visa) – for digital ads only (Facebook Ads, Google Ads, TikTok Ads, Taboola, Bing Ads, Apple Search Ads, etc)

- Universal Card (Visa) – universal card for any kind of payment

- 3DS Universal (Visa) – card for any payment operations with 3D secure support (code confirmation)

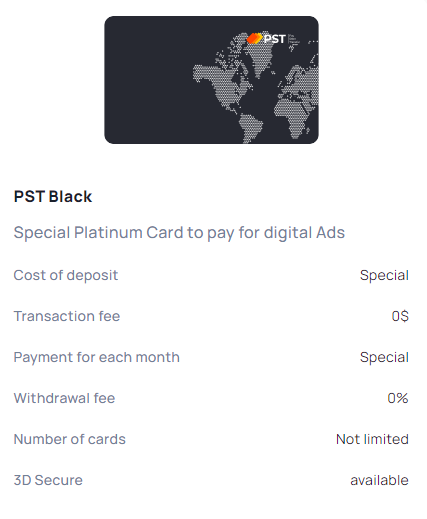

- Platinum Advertisement Card (Visa Platinum Credit) – card for digital ads only, with most trusted BIN and special conditions (according to customer support). Available through support service only, with ad spend more than 10 grand per month

- PST Black (???) – “virtual cards with Apple Pay support and ATM withdrawal, it’s private option for now, available via invites only” – that’s what we were told by the support after asking what type of card is this. Sounds interesting, as we have not met virtual cards with such options yet.

What are you?

Cards from Capitalist

Only one type of card (EUR) is available, yet you can issue 100 at a time, but this is not so simple. To issue a card, you will need to get the “Verified user” status and to get that status you will need to go through internal account verification (specify personal data, registration address and attach photos of documents). Support service comments: "further, when filling out an application for the issuance of a card, you can enter any cardholder data, the main thing is that the address must belong to one of the EU countries. This information will not be checked additionally in any way. When issuing each new card, it is necessary to enter completely new data in the application (name, address, mail, phone number)." It's unclear why we need to do this, but okay.

Capitalist virtual cards do not support 3D-Secure and Apple Pay / Google Pay.

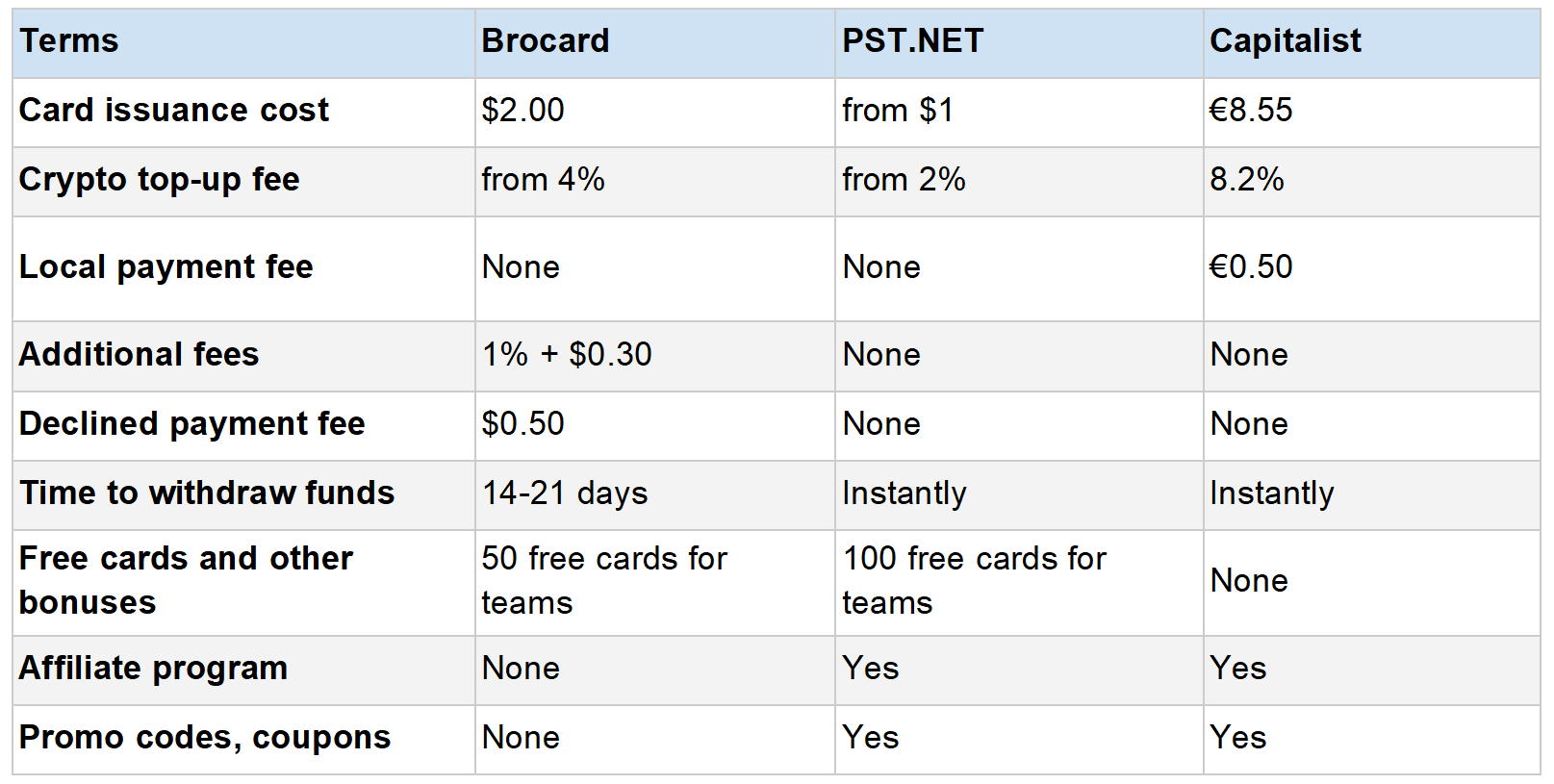

3. Fees

Card issuance is just the tip of the iceberg, the most important thing begins after.

Let's compare commissions and other conditions in different payment services.

Brocard Fees

There are several top-up options available, all with different fees applied: with Capitalist (6%), USDT (4%), WIRE (3%) and Marketcall partner network (2%). Top-ups are held through a support ticket system.

Automated USDT top-up is available for trusted accounts only (yet there is no definition of “trusted”). Automatic balance top-up through Capitalist requires the minimum amount of 500 US dollars and a commission of 7% (although it was 6% with top-up through a ticket).

At the time of the article preparation the fees were the same for all basic BINs:

- US payments without fees

- Fees for payments outside US – 1% + $0.30

- Declined payment fee – $0.50

- Card issuance – $2.00

Besides, there is a secret BIN 428816 with following commissions being promised:

- US payments more than $50 and international payments over $70 – no fees

- US payments under $50 (fee $0.29), international payments under $70 (fee $0,70). Those fees apply even in case the payment is declined (Decline) due to the low card balance.

Funds can be withdrawn from the account only upon request to the support. You will have to hand over your USDT address and wait quite a bit: support service promises to transfer money within up to three weeks, although the FAQ section indicates 14 days (temporary problems?).

We were told about the “50 free cards for new teams" promotion. There are no promo codes.

PST Fees

There are no account top-up commissions, yet there are card top-up commissions (depending on the card type) – starting from 2%.

You can deposit your account by yourself via USDT-TRC20 (deposit with ERC 20, BTC and WIRE proceed through support). It is possible to accept a direct WIRE transfer from the affiliate network to the PST account.

Top-ups with USDT are credited instantly, with BTC you will have to wait for two confirmations, as always.

Other PST fees:

- US payments without fees

- Payments outside US depend on the card bank rates

- Declined payment fees – none

- Card issuance cost – starting from $1

Funds are instantly withdrawn with USDT, without the participation of support service. Minimum amount for withdrawal is $500.

We have found promo codes for “free fifth card” and “first card for free, first deposit without commission”. At the time of article preparation there was a promotion for media buying teams – up to 100 cards for free, then $1 for additional cards, 2% deposit commission. This promotional offer is available to media buying teams with $30k+ ad spend per month.

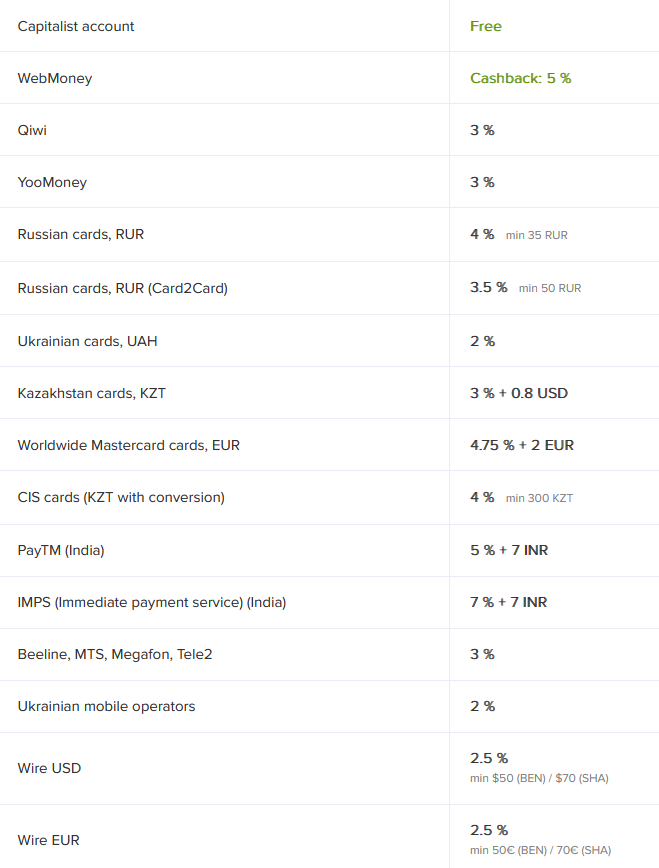

Capitalist Fees

To access operations with crypto (top-up, withdrawal of funds), customers have to verify their accounts – and then customers will be able to deposit their account using BTC, ETH, USDT (TRC 20 and ERC 20) and USDC.

No commission is charged for depositing funds with SWIFT/SEPA, but bank transfers are available only to verified users with a business account (contract needs to be signed).

Other Capitalist fees:

- Transaction fee – €0.50

- Declined payment fee – none

- Card issuance cost – €2.65 (maintenance fee €2.4)

- Additional services (payment search, wire payment refund and SWIFT request) – all for €50

- Card top-up from Capitalist account – 4.7% (€3.5 minimum)

- Conversion fee – 3.5%

In fact, the price to issue the card turned out to be much higher – 8.55 euro instead of 2.65 euro.

Refund from virtual card to Capitalist account – €1.

Yet there are many options for funds withdrawal: in crypto and many more.

Let's start from crypto:

The first three options have “dynamic commission, which is updated every few minutes”:

- USDT Tether (ERC20) 0.35% + 5 USDT

- USDT Tether (TRC20) 0.35% min 2 USDT

- USD Coin (ERC20) 0.35% + 5 USDC

The most well-known cryptocurrencies have more stable commissions (no notes on dynamic updates):

- Bitcoin 0.0001 BTC

- Ethereum 0.25% (minimum 0.01 ETH)

What are the withdrawal options besides crypto?

There are bank transfers in USD and EUR, PayTM and IMPS (Indian payment services), plus customers can withdraw the funds to a debit card from various countries (Mastercard Worldwide).

For some transfers between accounts (from USDT to USD) there are fees applied, for others (from USD to USDT) – 2.5%

At the moment this was written, only a promo code for a free card at Capitalist was found.

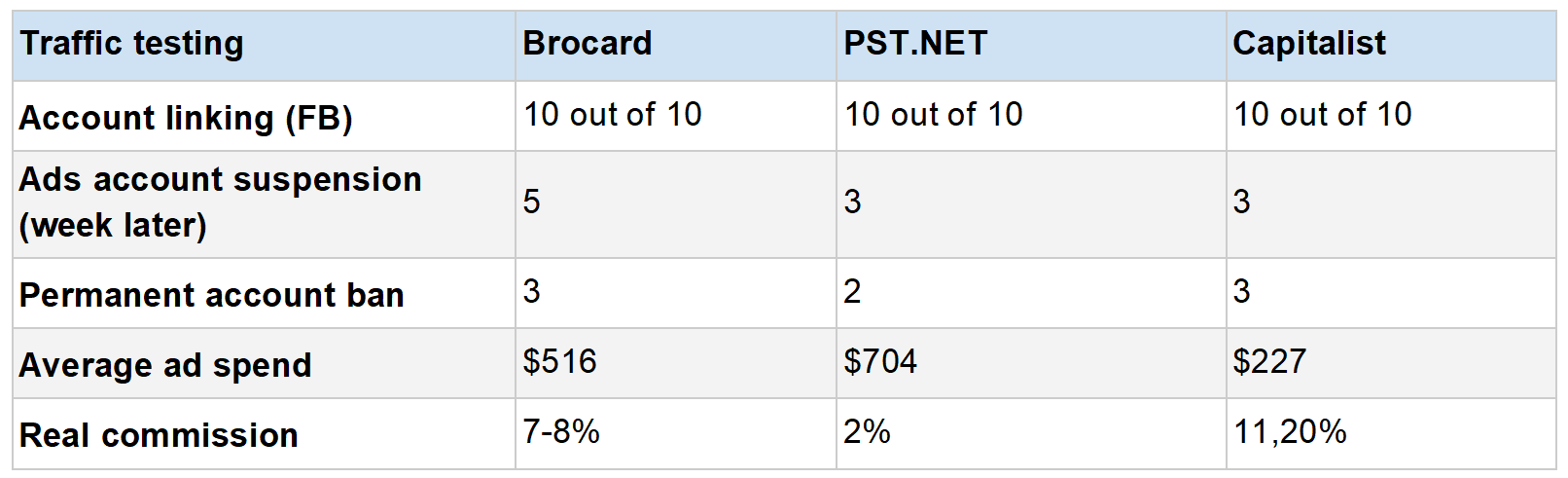

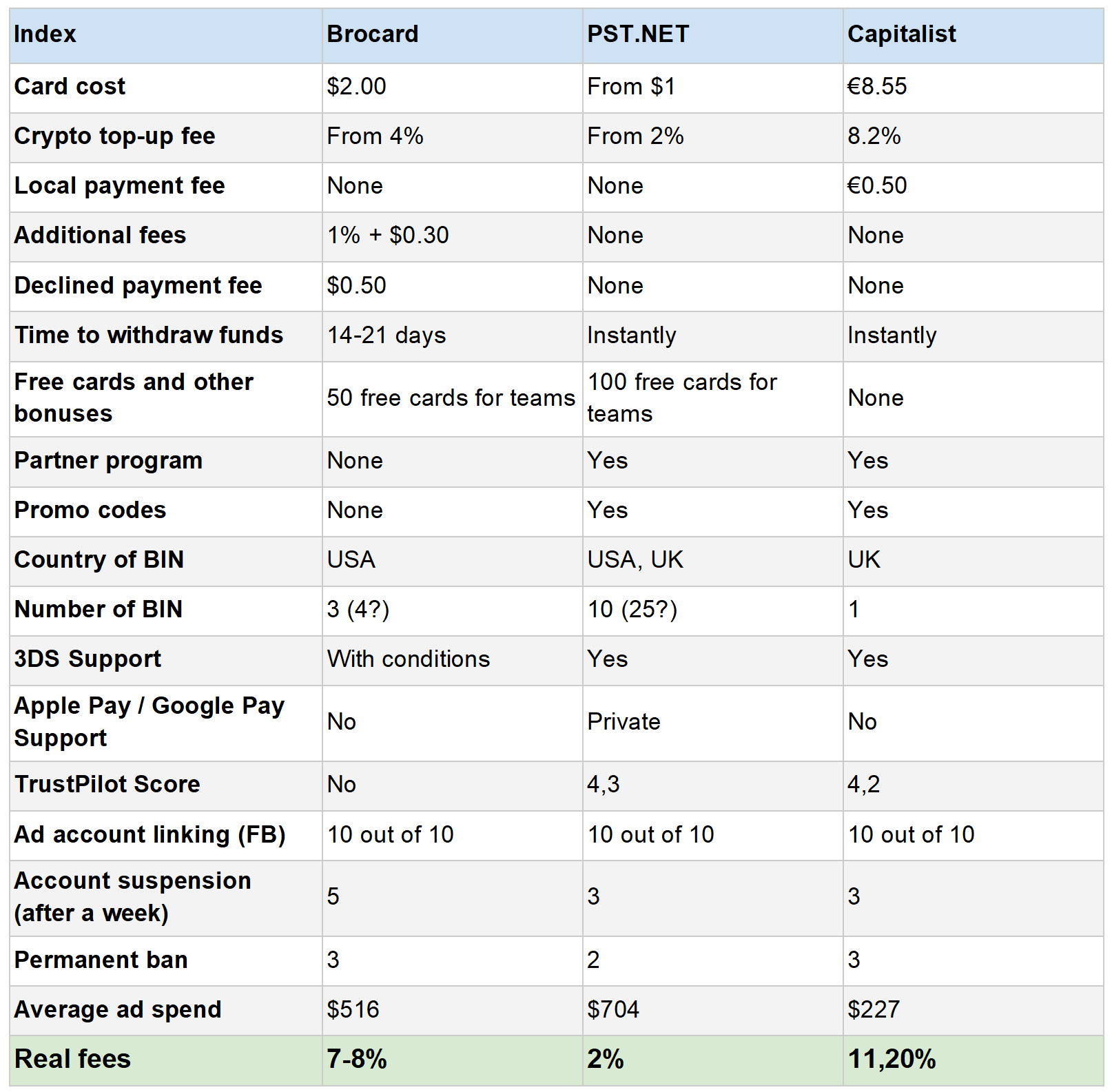

4. Traffic test

In the first place we checked the card's capabilities of linking to ad accounts (each card was linked to 10 FB accounts) and then we measured the results of running traffic from those accounts. Gambling offers from Grats.Network were promoted, tier 1 countries, our own app solution. Everything was set by a professional media buyer with many years of FB ads experience, so there are no questions for the technical part of test execution.

We have received an average spend data for each virtual card service, although that data cannot be called unambiguously representative – the quality of advertising accounts and other consumables could affect the results. Speaking of consumables:

- Accounts from AXFacebook shop – Ukrainian accounts 1-2 month old (Premium accs with 2 BM and new FP)

- Spaceproxy proxies – mobile (GEO: UA)

- Antidetect browser Indigo Browser (coupon code: GratsGroup. Thanks for that, Raf)

- GratsGroup apps

Brocard traffic test

Cards from Brocard were easily linked to all Facebook advertising accounts (10 out of 10), however, during the week of the test, 5 out of 10 accounts received an ad account suspension, after an appeal 3 were permanently banned. The average spend per account was $516.

It turned out to be very difficult to calculate commissions in the Brocard service – in addition to the fact that there are quite a lot of them (for account top-up, for USDT/USD conversion, for international payments), there are clearly non-obvious commissions (declined payments applied even on blocked and suspended cards) – as a result, the average commission on the service was 7-8%.

PST traffic test

Cards from PST were also easily linked to all FB accounts (10 out of 10). Week of testing, and 3 out of 10 accounts received an ad account suspension, after an appeal, 2 received permanent account ban. The average spend per account was $704.

The conversion of USDT/ USD was fixed at 1-to-1 rate – as a result, the real fees turned out to be 2% during the test, since we got the plan for media buying teams ($1 for a card and a very low deposit fee – 2%, plus they give teams up to free 100 cards). This seems to be the lowest commission for virtual cards on the media buying market.

Capitalist traffic test

The cards from Capitalist, like the first two services, were linked to all FB advertising accounts (10 out of 10). During the week of the test, 3 out of 10 accounts received a ban on advertising activities, after an appeal attempt, all three received a permanent account ban. The average spend per account was $227.

The real commission on the Capitalist service turned out to be the highest. Payments for transactions actually turned into an additional 3% commission, and together with the commission for top-up (4.7%) and the commission for conversion (3.5%), the service fee turned out to be 11.2%. Is it the price for a well-known brand?

5. Conclusions

Overall conclusion

- All the cards we tested were successfully linked to all Facebook Ads accounts (10/10). It’s up to you to decide whether our ads spend amount was meaningful.

- You need to be careful with any additional fees, as they might cost up to 70% of overall services fees.

- All operations with financial services (Wise, Revoult, etc) are prohibited on all modern virtual cards services.

- There are few cards with Apple Pay / Google Pay support

- 3DS is quite a rarity among virtual cards

Conclusions on Brocard

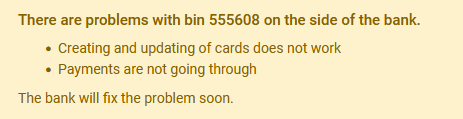

1.Cards from Brocard can be “suspended” and blocked so that all debit operations are declined. The problem is that Facebook regularly charges a commission for each declined ad payment – $0,50. It would seem to be a small amount, but for each unpaid bill, FB tries to make up to 20 attempts to claim funds from the card. This is stated in the official FAQ, we give the guys a plus for this, but it does not solve the problem itself – in fact, this is another hidden service commission, which can increase operating costs by another 10-20%, and that is a serious problem.

2.At the moment the article was written one of BIN showed some instabilities. We hope it does not happen much often.

3. Funny thing, there is no way to disable 2FA after it was activated. But that's more like a merit from the security point of view (if you will keep your Google Authenticator safe)

Conclusions on PST

1. Most BINs do not have Apple Pay / Google Pay support. That’s average.

2. There is no option for payment category limits (by mcc code). Operations with financial service are prohibited as well (Wide, Revoult etc).

3. On the other hand, there is a great variety of BIN available, as well as prompt sign-up process and attractive terms for media buying teams.

Conclusions on Capitalist

1. Strict account verification requirements. Customers can not top-up the account or withdraw funds from it without full KYC.

2. No 3D-secure support. That is not that important for media buying and digital ads, yet if the cards are meant to be used on other services, that might be a problem.

3. The highest fee for card deposit (internal transfer fee + conversion fee + transactions fee) – at least 11,2%

Final comparison

We are waiting for your requests

Today there are many virtual card services. After a brief market research we learned about Brocard, PST, Capitalist, Soldo, Karta, Ezzocard, Ecards, 4x4, EPN, Multicards, Spendge, Adscard, LeadingCards, Yeezypay, Kartex, Funnel Dash, Juni, Flexcard, Lamanche Payments and GCTransfer – but how many others have remained out of our sight?

For the first comparison we chose Brocard, PST and Capitalist – because they are “on the radar” in the media buying community. Yes, we would also like to make a table comparison with all the services at once, but such comparisons require a lot of time, and traffic testing is not cheap. If the format suits you, let us know in the comments, and we will test other virtual card services (write in the comments the names of services that you are particularly interested in).

Danya

Co-Founder Grats Group

https://t.me/d_invisible

.png)

.gif)

.png)