Since this year, problems with payments in arbitrage became particularly acute. In addition, Facebook started paying more attention to card quality and introduced pre-authorization. This has increased the number of accounts that are banned due to “Risk Payment”.

We know how to solve this problem!

Anybill is a service for issuing and managing virtual cards suitable for paying for ad campaigns on various platforms( Google, Facebook, Instagram etc.) You can top up your balance in USDT or via Wire in EUR. With Anybill, you have access to fast registration without KYC, private BINs, team-oriented features, 24/7 support, and no commission for opening/closing cards and operations.

Advantages

- Customized issuance of cards for teams in one click

- MasterCard, Visa, Union Pay

- UK BINs

- Private BINs are available

- Unified balance

- Detailed finance analytics

- 24/7 support

- No hidden fees (fee for deposits only)

- Fast Registration without KYC

- Fast USDT deposit

- Referral program

Getting started and the dashboard

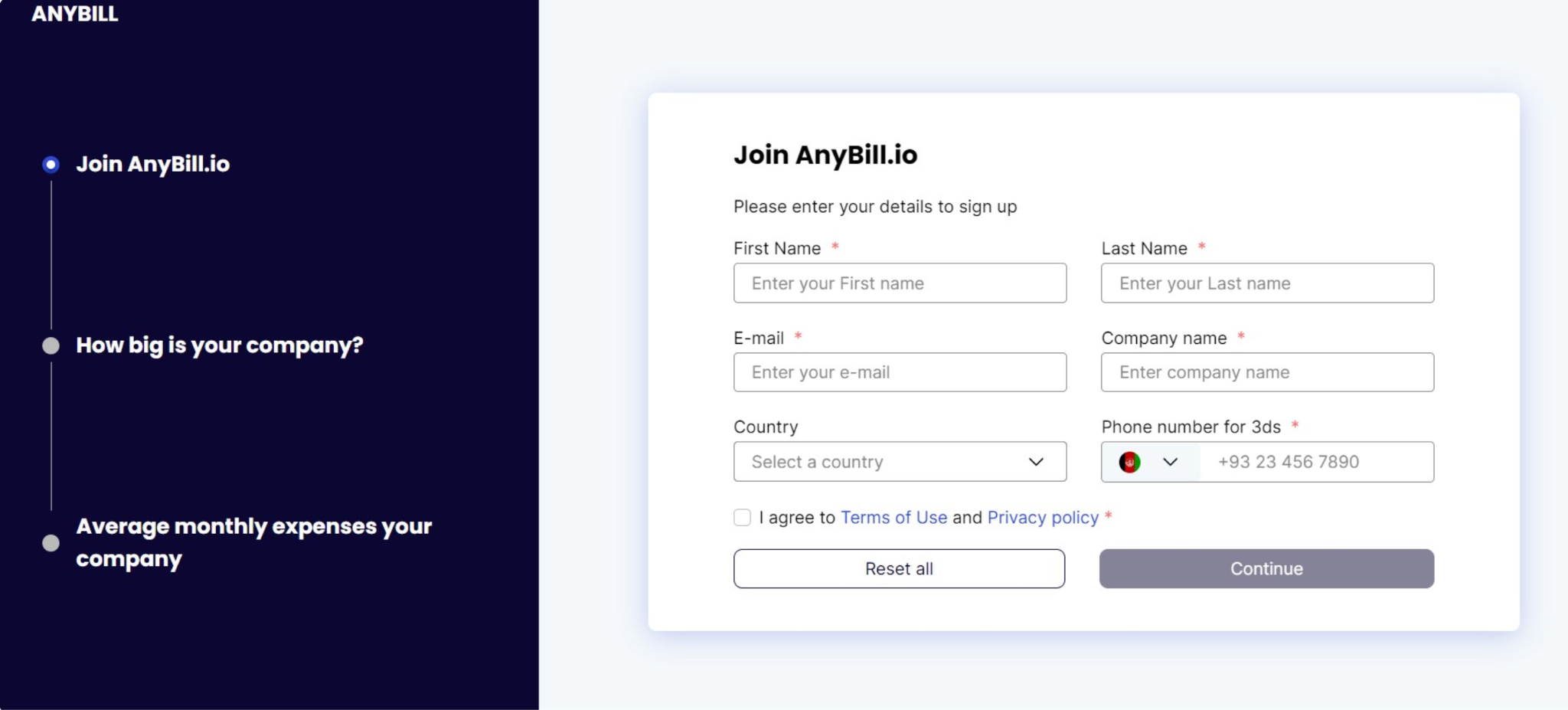

To start with the service, you need to register on the platform. To do this, on the Anybill website, specify your first name, last name, e-mail address, company name, phone number (for 3DS), and country of residence (optional).

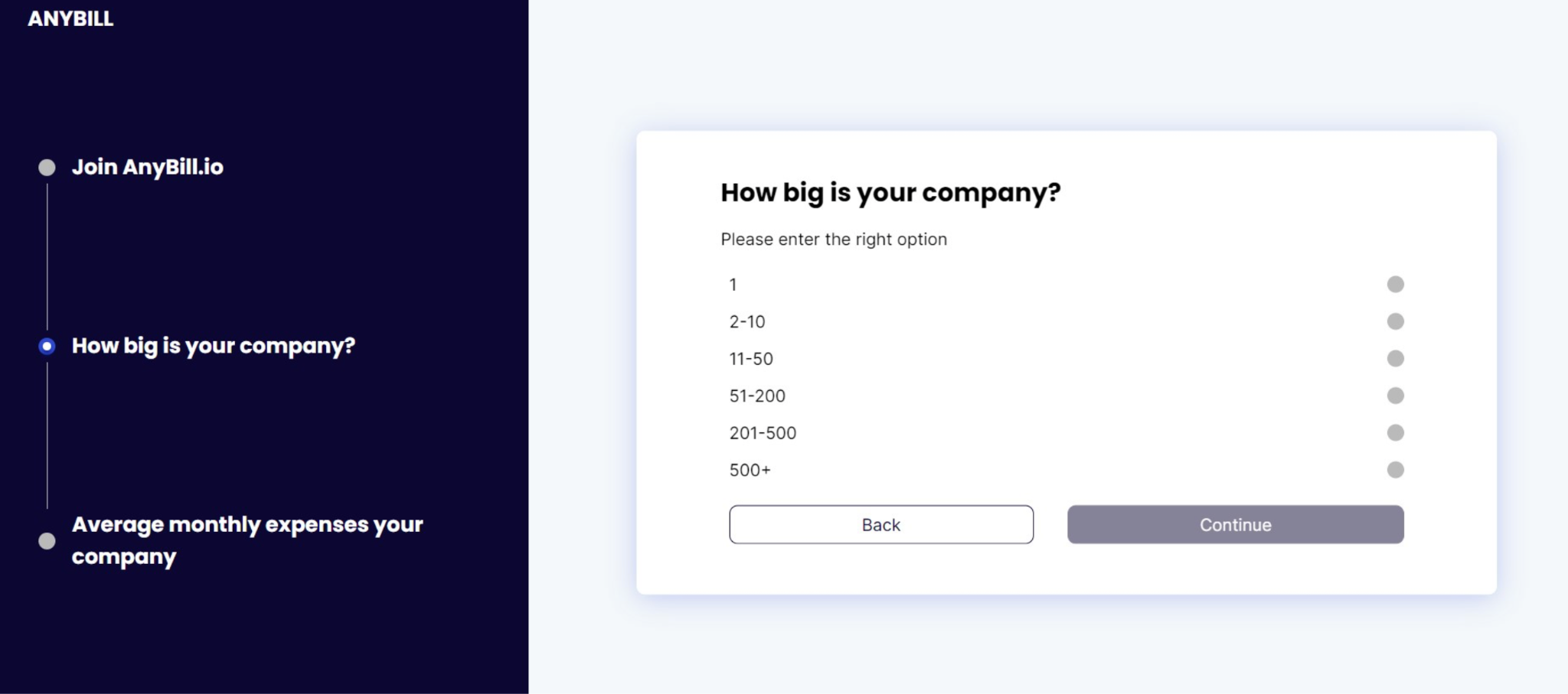

Then the service requires information about the size of your team (choose the number of people including yourself).

Finally, indicate the approximate advertising budget of your team per month.

After that, your application must be approved by the Anybill manager — you will receive a confirmation letter by e-mail. You need to follow the link in the letter and come up with a password. After that, you can start working with the platform.

What about your personal account?

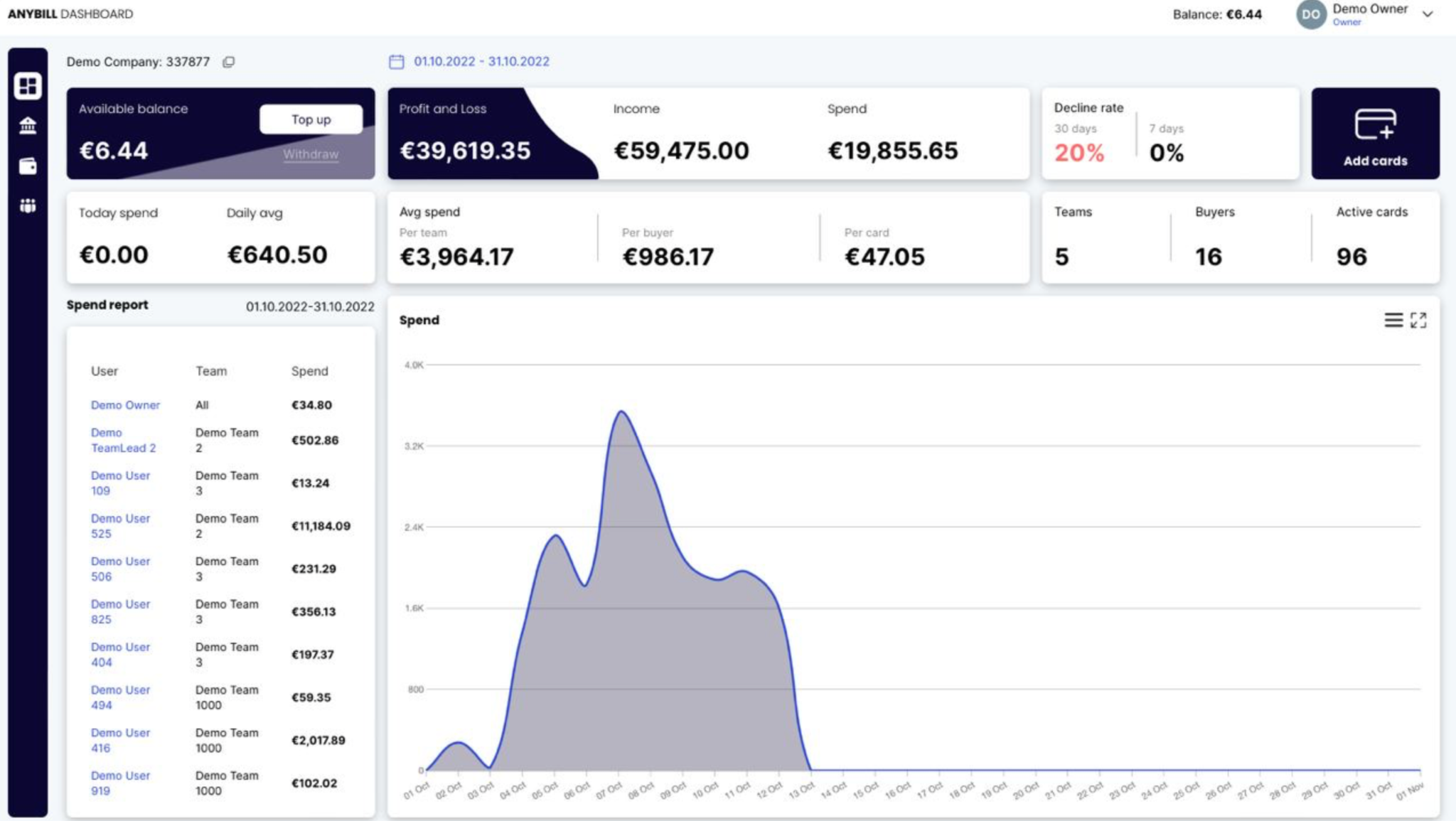

Dashboard. Here you can see your balance, the amount of profit and expense (which can be filtered by date and time period), and the average amount spent by the team/card/buyer. It also indicates how many teams, buyers, and cards are connected to the cabinet. For your convenience, there is a graph of your expenditures. The buttons for replenishing the balance and withdrawing funds are on the main page. You can also request a new card here.

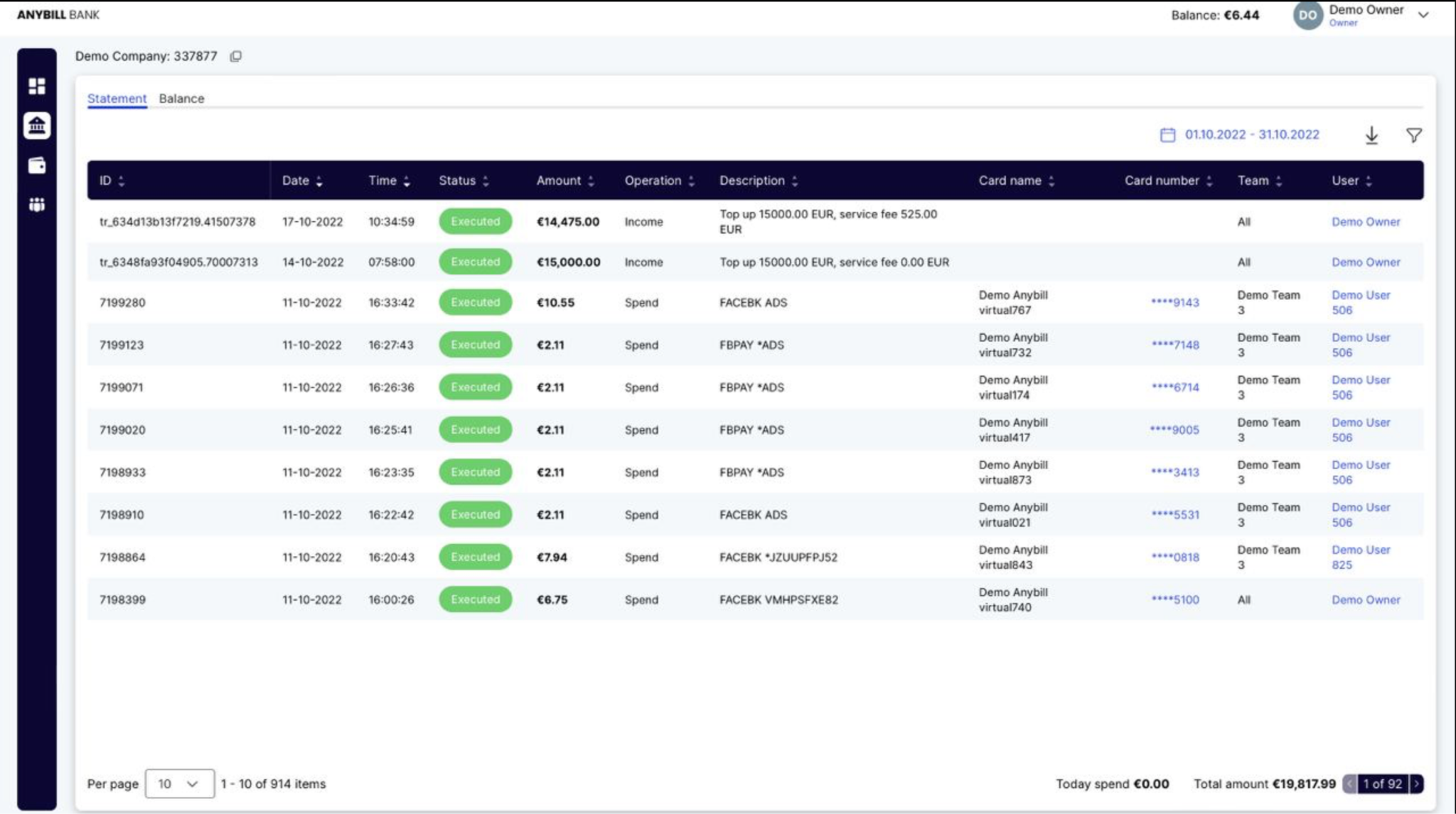

Bank. This section contains information on the account, considering the costs of each participant. Data can be filtered by date, time, ID, amount, operation, date, and team.

The second tab, Balance, displays the total amounts: income, expenditure, withdrawal, and the entire final balance. Information about transactions can be downloaded as an Excel document.

Wallet. This section contains information on the cards used. Here you can see information on working with a specific card or with all cards, get data on your transactions specifically or any operations with the cards. The information can be filtered by date.

Team. Here you can find information on the participants who have access to the service: their names, which team they belong to, work status, number of cards, and e-mail address. It helps to analyze the spending better.

Here there is also an Invite users button. You can invite new members with its help.

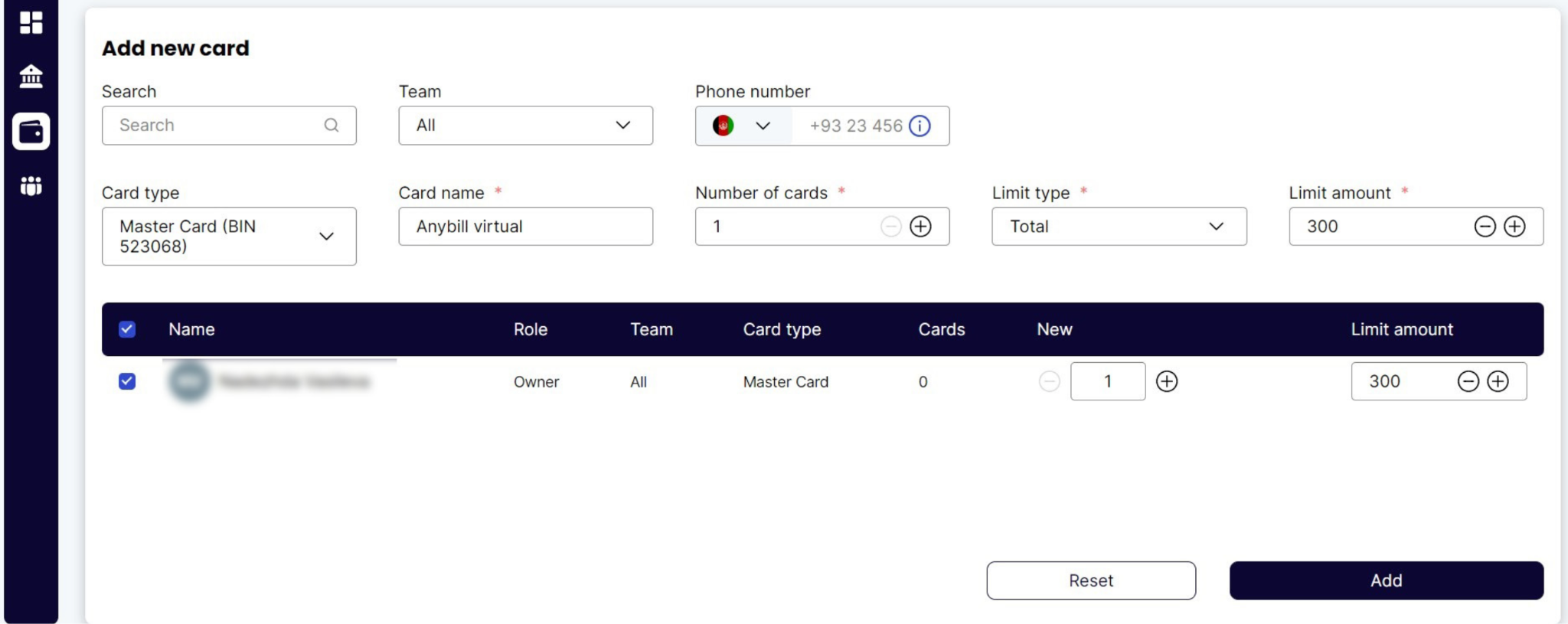

To order a card, click on the “Add cards” button. In the window that appears, specify the command if any, and phone number (for 3DS codes), select the type of card, come up with the name of the card (Anybill virtual), the number of cards, the limit option (general, monthly, weekly, daily) and the amount limit.

Terms and conditions

Cards are issued and replenished quickly. The stable quality of the cards is ensured by the system of automatic monitoring and control of the operations’ success using BIN (paid private BINs).

Anybill offers mass issuance of virtual cards to pay for advertising, as well as to monitor company/team spending. The service works with all advertising platforms (if the MCC transaction code matches advertising services, payments will go through without a hitch). Upon individual request, you can issue cards for other expenses.

In addition, Anybill makes it possible to work in a team. You can create a corporate account and invite other members to it. It is also possible to invite employees and assign them roles according to the hierarchy in your company. Thus, each team member will see the information they are supposed to see. For example, a buyer sees only his activities and cards, a team leader sees the activities of all his buyers and himself, and the owner sees everything.

In conclusion, if you are looking for a solution to your payment problems, AnyBill is definitely worth considering. Its user-friendly interface, flexibility, security, and affordability make it an excellent choice for businesses and individuals who want to manage their payments more efficiently.

.gif)

.png)

.png)